Overview

The City of Cleveland has been utilizing Community Benefit Agreements (CBAs) for development projects for over a decade. Official legislation, the Community Benefits Ordinance (CBO), passed by the City Council in June of 2023, outlines a legal framework for how CBAs are applied, the process for how they are developed, and the kinds of benefits the City would like developers to prioritize. This ordinance also outlines expectations for publicly reporting contracting and workforce data. The CBO legislation went into effect officially in September of 2023.

The City of Cleveland recognizes that it has a unique role in ensuring that development projects directly benefit the communities in which they are built and that public dollars benefit the entire community, including historically underrepresented minorities, women, and small businesses. While the baseline for a CBA includes meeting the MBE/FBE/CSB and local workforce targets the City has required for years, we believe a strong CBA can build from that base and help impact our City in a myriad of other ways. An investment in time to discuss community benefits early in the project can create a more meaningful and impactful project for the community, the developer, and the City.

The City of Cleveland has designated two types of Community Benefits Agreements - Standard CBA and Expanded CBA.

A Standard CBA is for all projects receiving $250,000 or more in City assistance and under $20 million in total cost (including residential tax abatements for projects under $75 million); the CBO outlines a set of mandatory community benefits.

An Expanded CBA is for all projects receiving $250,000 or more in City assistance with a project cost of over $20 million (including residential tax abatement projects over $75 million in total cost). An Expanded CBA includes the mandatory community benefits listed in the Standard CBA; it must also be coupled with additional community benefits to be considered for legislative approval. The CBO provides a great deal of flexibility in determining the appropriate additional community benefits related to the project. The CBO provides categories and suggested considerations of additional community benefits along with associated requirements that must be met.

This ordinance also requires Developers to meet with members of the community to ask for their feedback on the project and any additional benefits they might like to see included in the agreement.

Once a set of community benefits is agreed upon, City Representatives will present the development project’s incentive package with the associated community benefits for first review by the Cleveland Citywide Development Corporation (CCDC), an advisory nonprofit board that helps the city with its real estate deals, and then to Cleveland City Council for legislative approval. CBAs must be presented at the same time the City administration presents the financial incentives for legislative approval.

Based on the CBO, City Council cannot approve any development project incentives, nor can the City close on any incentive agreements or contracts until all community benefits are agreed upon. Therefore, the preference is to begin the conversation about community benefits early in the process; however, the Administration will not engage in the process until the Developer has a firm development project that will move forward. Before meeting with the Administration, the Developer should have a proforma for the project along with a site plan and development timeline.

It is critical that The Developer does not begin construction on the project until both the project incentives and community benefits have been fully approved. Doing so may result in the City disapproving or pulling back the incentive.

The Developer must submit contracting, workforce data, and all other community benefits compliance information to OEO, who will then be required to share quarterly updates of this information with City Council and the public, via a public data dashboard.

Lastly, this ordinance outlines penalties that may be included in the CBA for possible non-compliance, up to and including termination of city financial incentives

Mission, Vision, & Purpose

Mission

Our unwavering mission is to create a vibrant and inclusive community that embraces diversity and empowers all residents to thrive. Through our steadfast commitment to providing affordable housing, growth opportunities for businesses, high-quality employment, public amenities, civic engagement, public health, fair allocation of resources, and fostering community connections, we will continue to build a better tomorrow for all.

Vision

Our vision is to create a brighter and more sustainable future by building a smart and efficient physical environment that harnesses the power of public and private resources. Through collaboration and joint efforts, we aim to inspire positive change that is sustainable and encourages continued growth.

Purpose

Community Benefits Agreements (CBAs) are legally binding documents that allow residents to benefit from development projects. CBAs can provide economic opportunities for residents, leading to economic growth and mobility. To ensure transparency and accountability, a Community Benefits Ordinance (CBO) is crucial, which would regulate and monitor developments that use public funds.

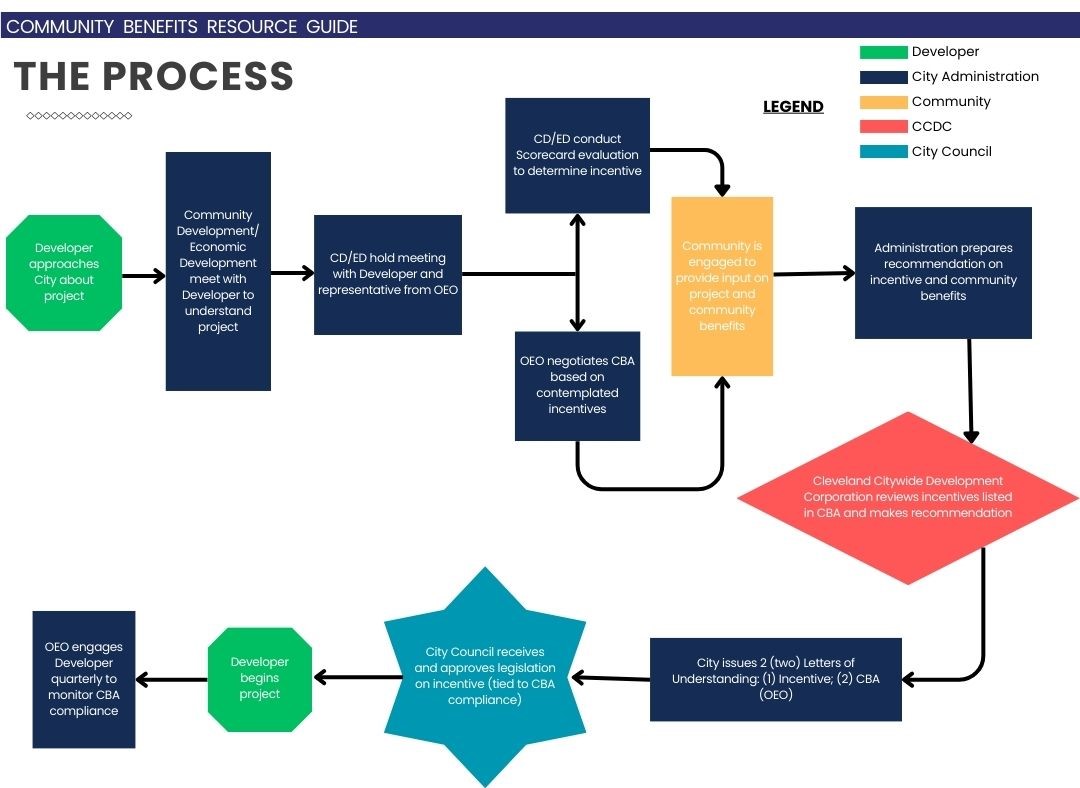

The Process

FAQs

What is a CBA?

A Community Benefits Agreement (CBA) provides a framework for developers and community representatives to work together constructively toward the common goal of creating better and more equitable development projects. By establishing clear and enforceable obligations, CBAs encourage transparency, accountability, and collaboration, helping to build trust and foster positive relationships between developers and communities. Through this process, CBAs can play a vital role in promoting shared prosperity and ensuring that development projects deliver meaningful benefits to the communities they serve.

Who is Involved?

- Developers - The Developers seeking support for a new project are always involved in the negotiation of and are a party to the CBA.

- Community Coalitions - Community coalitions are a necessary party to any CBA to ensure that the community itself is engaged in the negotiation of a CBA and will benefit from the development.

- City Administration - City administration can assert their inclusive leadership by (1) being transparent about the project; (2) insisting on gaining broad community support for project approval; and (3) actively encouraging CBA negotiations without any attempt to influence them.

How long is the process?

The length of the community benefits agreement process is dependent upon effective and timely communication between all stakeholders, developers, and city administration. The City of Cleveland is committed to operating at the speed of business to ensure that all parties are progressing toward a final CBA closing date.

Are CBAs mandatory?

A CBA is required whenever a Developer is awarded a city financial incentive that equals $250,000 or more. For projects that have a total cost of 20 million or more are considered large projects are which required to have additional community benefits.

How to find certified contractors?

To find a list of City of Cleveland certified vendors, please visit the City of Cleveland website under the Office of Equal Opportunity webpage and click “Certified Vendor Directory” located in the Resources Links section.

What does it take to get certified as an MBE/FBE/CSB?

- Certification requirements

- Ready, willing, and able to perform work in the area it seeks certification

- Located in the Cleveland market area

- Owned and controlled at least 51% by a minority or female

- Required documents

- Affidavit of Certification (New)

- Identification

- Federal tax returns

- Articles of Organization or Incorporation certificate copy

- NAICS Codes

Note - Other documents may be required depending upon the type of business and the business structure.

What are the benefits of a CBA for the Community? Developer? Administration?

- Community:

- Job creation

- Local and diverse hiring and training commitments

- Living wage and other benefits

- Education partnerships between developers and community schools

- Support for local small businesses

- Improvements to open spaces, parks and playgrounds

- Affordable housing and rehabilitation

- Support for senior centers and child-care facilities

- State and/or local economic incentive packages

- Developer:

- Community support reduces risk for developers by fostering cooperation between government and community groups

- Developers get needed public subsidies and/or government approvals more reliably

- Community coalition agrees to support the project with public testimony and written statements

- Administration:

- Keep lines of communication open to ensure consistency with the city's policy goals

- Creates a fair and open process for establishing achievable targets within the community

- Creates transparency with community on development projects within the City of Cleveland

- Creates an opportunity to improve the local economy through dedicated job creation and small business utilization

What penalties will there be if the Developer does not comply?

If the City determines that the Owner/Developer has failed to fulfill each of the required elements of this Agreement, the City is deemed to have been damaged. If the Owner/Developer does not cure such failure to the reasonable satisfaction of the City within 30 days after receiving such notice, the City may assess a penalty against the Owner/Developer up to 25% and/or including denial or termination of all city financial assistance.

What happens if the Developer tries to comply but does not get a response from a critical partner or cannot find the right contractors?

For optimal success, it is imperative that all designated parties maintain an open line of communication. This will help lessen any chances of receiving future penalties for failure to comply, enable the City representatives to provide assistance and help the City Administration determine the severity of any applicable penalties for non-compliance. The goal is to address any unforeseen issues as soon as possible rather than at the end of the project. Good faith efforts and other accommodations may be taken into consideration as long as the Developer makes City Administration aware well in advance.

Key Terms / Definitions

City Financial Assistance - any grant, loan, tax increment financing, residential multi-family tax abatement in compliance with Ordinance No. 482-2022, Section 3, below market-value land transfer, and/or City-funded capital infrastructure improvements associated with a development project

Contractor - a prime contractor, a subcontractor, or any other business entering into a contract with the Developer related to the use, maintenance, or operation of the Project or part thereof

Community Benefits Agreement or (CBA) - a legally enforceable agreement between the City of Cleveland and the Developer that provides community benefits

Community Benefits - the amenities, benefits, commitments, or promises described in Sections 191A.02 and 191A.03 of this Chapter

Construction Worker Hours - the total hours worked on a Construction Contract by Skilled and Unskilled Construction Trade Workers, whether those workers are employed by the Contractor or any Subcontractor. In determining the total Construction Worker Hours to be furnished at the construction site, there shall be included the number of hours devoted to all tasks customarily performed on a construction site, whether or not such tasks are, in fact, performed on the construction site. Construction Worker Hours excludes the number of hours of work performed by non-Ohio residents

Developer - any person, firm, partnership, limited liability company, corporation, joint venture, proprietorship, or other entity that proposes a Development Project, excluding public improvement projects, in the City of Cleveland

Development Project - new construction of and alterations to buildings and structures located in the City

Low-Income Resident - means a City Of Cleveland Resident who, when first employed by a contractor, is a member of a family having a total income equal to or less than the "Section 8" Low-Income limit established by the United States Department of Housing and Urban Development. Low-income family is defined as a family whose annual income does not exceed eighty percent (80%) of the median family income for the area in which they reside, as determined by HUD. Income limits are adjusted for family size. A Resident who is not a member of a family shall be considered as a one (1) person family for this purpose. A Resident shall retain "Low-Income Person" status for a continuous five (5) year period starting upon the OEO's written acknowledgment that the Resident's family income does not exceed the above-stated limit, provided the Resident remains a Resident during the five (5) year period.